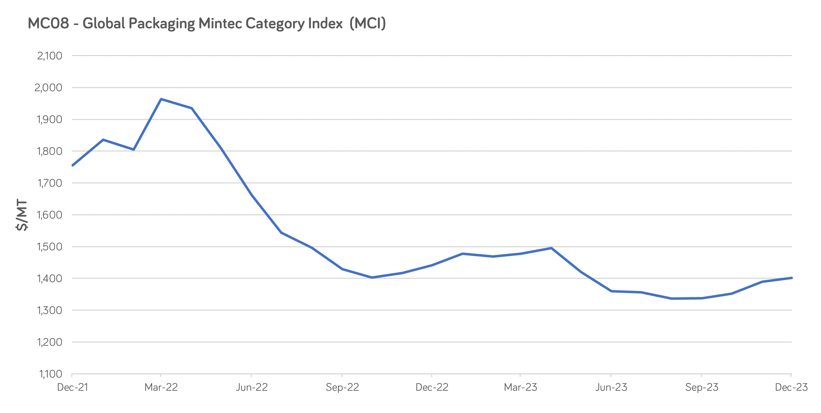

The Mintec Global Packaging Category Index (MCI) [Mintec Code: MC08] was estimated to have risen by 1% month-on-month (m-o-m) to $1,402/MT in December. Prices for most packaging materials fluctuated within a small range in December. However, prices for raw materials for paper and steel production rose over the period.

On average, the Mintec Global Packaging Category Index fell by 15% year-on-year (y-o-y) in 2023, and by 16% compared to 2021. The fall in fuel and energy prices that started in H2 2022, as well as lower sea freight costs, led to a decline in production costs. Also, on the back of weak demand for packaging products, production declined, which in turn led to a surplus of raw materials and lower raw material prices.

Market players no longer expect demand to decline as the market seems to have bottomed. However, many point out that the market grew excessively during the COVID 19 pandemic, leading to normalization in 2023. The supply of various materials for the packaging industry is also tight, so many sources say that the market is moving close to balance with less pressure on inventories.

Source: Mintec Analytics

Plastics

In the plastics segment, all prices in Europe declined in December, with EU polypropylene [Mintec Code: 2O53] falling 5.3% m-o-m to €1,301/MT. The EU plastics market remains well supplied, while high costs of borrowing have negatively impacted demand. The price of raw materials, namely paraxylene, ethylene, and propylene, all declined during the month, adding further bearish pressure.

In the US, the sentiment was mixed, with prices for polyethylene falling on increased stocks and weak demand, while polypropylene and PET prices rose due to logistics disruption in the Red Sea. For reference, the price of US HDPE [Mintec Code: 2O81] decreased 18.7% m-o-m, to USc 61.3/lb. The price of US PET [Mintec Code: 2O89] was USc 65/lb, a 1.6% m-o-m increase.

In 2023, the demand for plastics in the EU and the US was fundamentally weak, so the cost of production was the main price driver. In particular, the main indicator of raw material prices was crude oil prices, which remained on a downward trend by the end of the year.

Nevertheless, the US plastic market showed a slower decline in prices compared to the EU market, as exports of plastic from the US allowed the redirection of excess volumes from the domestic market. Moreover, high export demand has led to strong production levels and was reflected in high demand for raw materials. As a result, propylene steadily increased in price in 2023 and US PP [Mintec Code: 2O85] prices were USc 111/lb, soaring 52% y-o-y in December.

Metals

In December, steel futures prices in the US market started to decline after dynamic growth in the previous month. The CME's US steel hot-rolled coil (HRC) [Mintec Code: HRCN] 3-month price fell by 13% m-o-m to $1,102/MT. HRC prices in the EU [Mintec Code: 1K01] rose by 5% m-o-m in December to €681/MT as European producers incrementally raised prices to counter rising input costs. Tinplate prices continued to increase in the US and EU in December.

The year 2023 was a complicated year for steel producers as steel prices fell faster than production costs due to weak demand. Aggregate European steel production for the first 11 months of 2023 fell by 8% y-o-y.

Tin prices fell by 16% y-o-y in 2023, but the mid-year shutdown in Myanmar resulted in undersupply of raw materials, as Myanmar is an important supplier to China. Nevertheless, the deficit was slight, and the rush in demand led to LME stockpiles in December reaching a nine-year high.

The LME aluminum 3-month price [Mintec Code: LN02] changed little m-o-m in December. After falling in H1 2022, aluminum prices have fluctuated within a small range over the past year and a half, primarily due to a surplus global market.

The US and EU are increasingly concentrating on producing less energy-intensive secondary aluminum, or buying semi-finished primary aluminum, while Asia and the Middle East actively increased the supply of primary aluminum on the global market.

According to the European Foil Association, domestic aluminum shipments fell by 13% y-o-y for the first nine months of 2023. Demand for aluminum cans also declined following a 4% y-o-y drop in beer production in Germany for the first 11 months. In the US, beer production fell by 6% y-o-y for the first nine months of the year.

However, despite weak demand in the US and EU markets price for aluminum cans and foil on average for 2023 fell 8-12% y-o-y, while the LME aluminum 3-month price fell 16%. The slower decline in packaging products was due to high other costs in the production of aluminum products.

Paper

In December the packaging paper market showed weaker than expected demand. French Kraftliner 175g [Mintec Code: SZ173] prices managed to keep from a significant decline, fell only 1% m-o-m in December due to the rising cost of pulp, which is the main raw material. French Testliner 2 [Mintec Code: SZ176] declined by 3% m-o-m as producers were able to reduce prices due to a 14% m-o-m drop in corrugated waste prices.

Paper production in the EU, as measured by Eurostat, bottomed out in July 2023 and then stabilized. This level is comparable to May 2020, when the world faced the first wave of COVID-19, suggesting that current business conditions are relatively weak. According to some reports, it appears that the production cuts are finally taking effect and the market has approached equilibrium.

Demand for paper packaging is fundamentally weak and manufacturers are somewhat pessimistic about Q1 2024. Consumers are constantly looking for a lower price, while manufacturers claim that production costs are high.

However, it is worth noting that energy prices such as electricity and natural gas, which largely determine the cost of production of paper products, have completely offset the price increases of the previous two years in 2023. Market players do not expect energy prices to have much upside potential in 2024. In terms of electricity, the EU is implementing programmes to stabilize electricity prices and avoid large fluctuations in the future, in order to stimulate the development of industrial business. Natural gas supplies to Europe have been diversified and dependence on Russia reduced, reserves are at a high level and no risk events are expected.

At the same time, raw material prices, and pulp in particular, will be a possible growth driver. In autumn 2023, pulp producers for the paper industry in Europe said they see growing demand. As production declined, market sources believe that the balance between supply and demand has been achieved. As a result, the price of Northern Bleached Softwood Kraft (NBSK) pulp [Mintec Code: EX24] has risen by 11% over the past four months.

Glass

The container glass market continues to be defined by ample supply and declining demand as buyers navigate an environment of persistently high borrowing costs. Additionally, natural gas prices [Mintec Code: NGNL] continue to decrease following a period of above-seasonal temperature that reduced demand, while European storage levels remain high. The cost of raw materials, namely silica sand [Mintec Code: TT51] and soda ash [Mintec Code: WY31], remains a watch-out factor, as market participants caution that shipping disruption in the Red Sea could result in higher prices.

For further insight sign up for early access to our H1 Industrial Materials 2024 eBook. Equip your business with strategic intelligence to navigate a challenging industrial materials market. This eBook delves into high-level macroeconomic trends, industry impacts, and the reflection of these dynamics on industrial commodity prices.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)