Feed Prices and Weak Krone Continue to Support Norwegian Salmon Spot Price Above 5-Year Average

After peaking at a nine-month high of NOK 118.8/kg on 3 January, Mintec Analytics data shows that the weekly average Norwegian salmon price (3-6kg, Fish Pool Index, spot price) oscillated between NOK 100-109/kg over the ensuing four-weeks. At NOK 107.1/kg, the monthly average for January 2024 was 53% above the five-year average (NOK 70.0/kg) for 2019-2023, gaining support from supply factors.

Feed componentFeed is a key cost component of Norwegian farmed salmon, comprising approximately 45%-55% of the farmed Norwegian salmon cost, according to Mowi, one of Norway’s largest salmon producers.

Aqua feed ingredients like soy meal and fishmeal aggregately account for around 60% of the salmon feed costs, followed by fish oil, which is the priciest input cost on a per tonne basis.

Global fish oil prices continue to trend near record highs, due to a combination of adverse weather conditions, geopolitical instability, and high energy prices.

Weather & War Impacts

On the weather font, El Niño conditions are likely to continue in the tropical Pacific Ocean region until at least early Q2 2024, characterised by above-average sea surface temperatures, to the detriment of anchovy production in Peru, the world’s largest exporter of fishmeal and fish oil.

The wars in Ukraine and the Middle East impart volatility into fuel and fertiliser markets, which also have knock-on price potential for plant meal and plant oils. Moreover, disruptions in the Suez Canal and Panama Canal, key shipping routes to Europe and the Americas, continue to hamper commodities’ trade at the time of writing.

Aqua Feed Markets

Many participants expect global aqua feed markets to remain volatile through the next 4-6 months, heightening bullish salmon market fundamentals.

Market sources also noted a slow end-year Norwegian harvest in December 2023, caused by unseasonably cold sea temperatures, lowering the salmon feed conversion ratio, and reducing feed demand. This squeezed the pool of market-ready salmon, as evidenced by recent trade statistics.

Market Dynamics

The Norwegian Seafood Council reported that Norway exported 86,985 tonnes of salmon in January 2024, representing respective contractions of 5% m-o-m and 2% y-o-y, while the export value increased by 11% y-o-y. This market tightness is pertinent, as Q1 is a period when many of the major retail salmon buyers will begin contract negotiations for H1 deliveries.

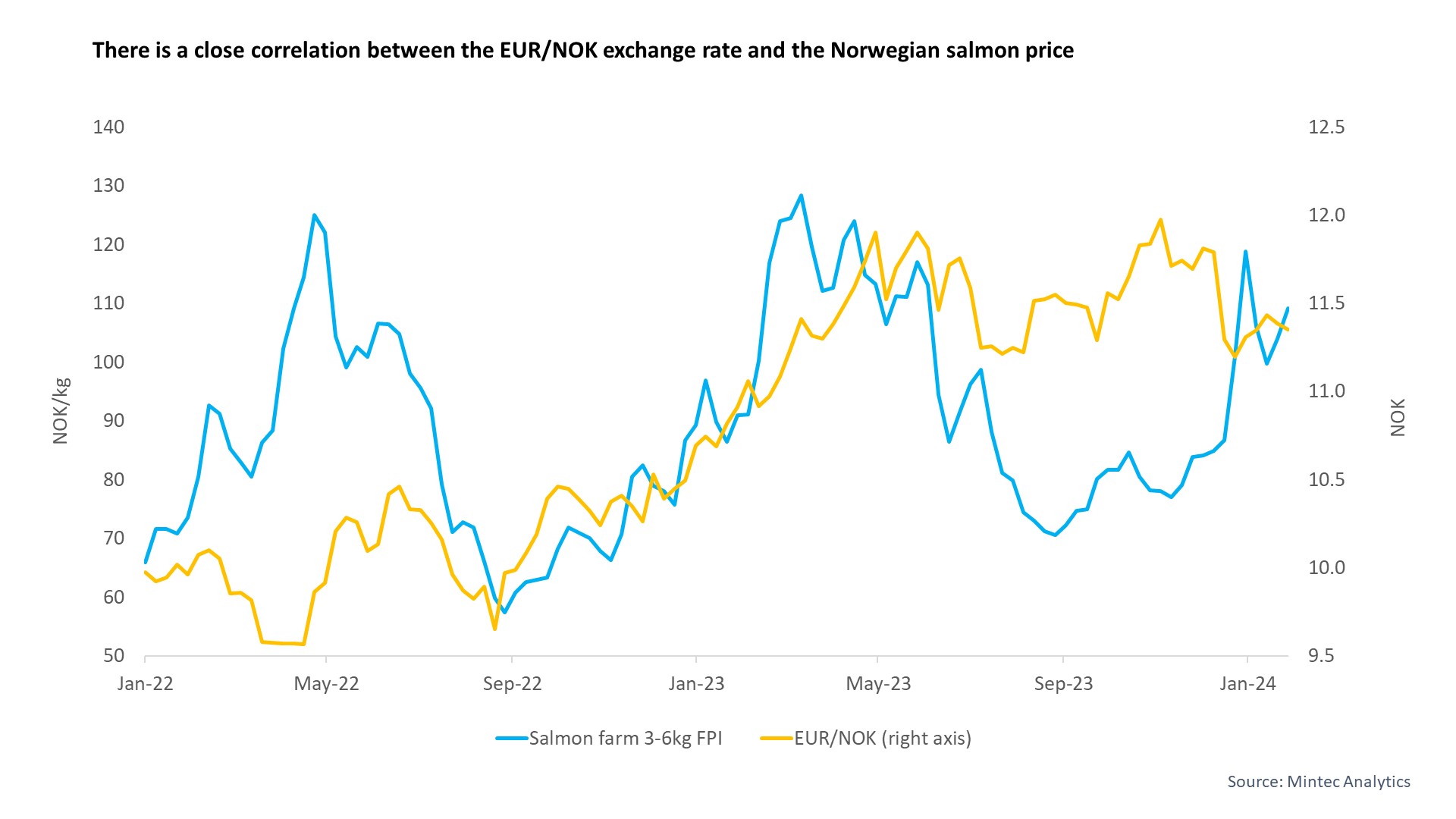

Exchange rate dynamics, particularly the strength of the NOK against the EUR, is another factor lending price support to Norwegian salmon prices. The NOK depreciated by 1.4% against EUR during five-weeks ending 31 January 2024, and there is typically a strong positive correlation between the EUR/NOK rate and the Norwegian salmon price, as the latter tends to increase as the NOK weakens. Indeed, the salmon price increased by 8% over the same five-week period, due to two main factors.

Firstly, a weaker NOK implies that the costs of imported inputs and other supply chain costs increase for Norwegian salmon farmers, which are often passed on to buyers. Secondly, a weaker NOK also raises the value of Norwegian salmon sold in EUR and converted to Norwegian currency. Approximately 40-60% of Norwegian seafood sales are NOK denominated in a typical year, according to market sources.

The Norwegian salmon industry has recently been under scrutiny with the news that six of the largest producers are being investigated by the European Commission (EC) for potentially breaching antitrust protocol. The companies are alleged to have colluded in setting salmon prices on spot sales into the European Union between 2011-2019.

The investigation has important potential ramifications for the Norwegian industry, including fines of up to 10% of annual turnover, which could limit industry growth potential.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)