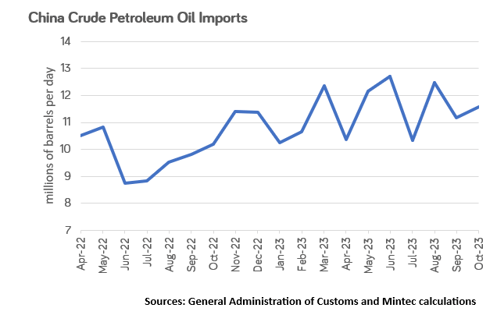

According to data from the General Administration of Customs and Mintec calculations, China imported an average of 11.58m barrels per day (bpd) in October, up from 11.18m bpd in September, a 3.6% m-o-m increase, representing a 13.5% y-o-y rise.

The Chinese economy again slipped into deflation in October at -0.2% y-o-y, while the manufacturing purchasing managers’ index (PMI) moved into contraction territory (marked by a value below 50) at 49.5; there was a rise in input cost inflation due to the elevated crude oil price and other raw materials. Industry sources state that domestic demand remains sluggish. Market sources, therefore, anticipate greater government stimulus to generate increased domestic demand. Additional data is required to understand the full ramifications for the Chinese economy and the consequent impacts on the crude oil market.

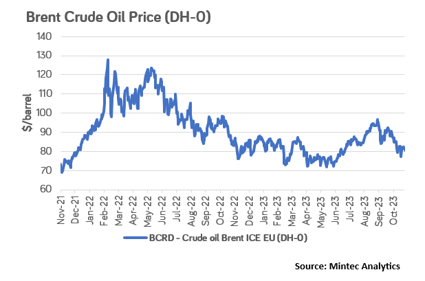

For reference, the Brent crude oil price (DH-0) [Mintec Code: BCRD] was $80.58/barrel on 24th November, down 10.9% month-on-month, representing a 3.7% year-on-year decrease.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

.png)