Brazilian sugar production during its current marketing year (Apr ‘22-Mar ‘23) is expected to benefit from farm yield improvements, due to better weather conditions. Pervasive drought afflicted Brazilian sugar plantations resulted in domestic sugarcane production contracting by 70 mn tonnes (-10.7%) year-on-year (y-o-y), to 585 million tonnes, during the 2021/22 season. However, despite lower planted area, the Brazilian agricultural marketing agency, Conab, projects cane yields to improve by 2.2 t/ha (+3.1%) y-o-y in 2022/23 to 72.6 t/ha. Conab predicts that Brazil will harvest 596 mn tonnes of sugarcane in 2022/23, which would represent y-o-y growth of approximately 11 mn tonnes (+1.9%), although significantly below the 655 mn tonnes harvested in 2020/21. Based on the expected improvements in farm productivity and output, Conab forecasts Brazilian sugar mills will crush 40.3 mn tonnes of white sugar in 2022/23, representing 5.3 mn tonnes y-o-y growth (+15.1%).

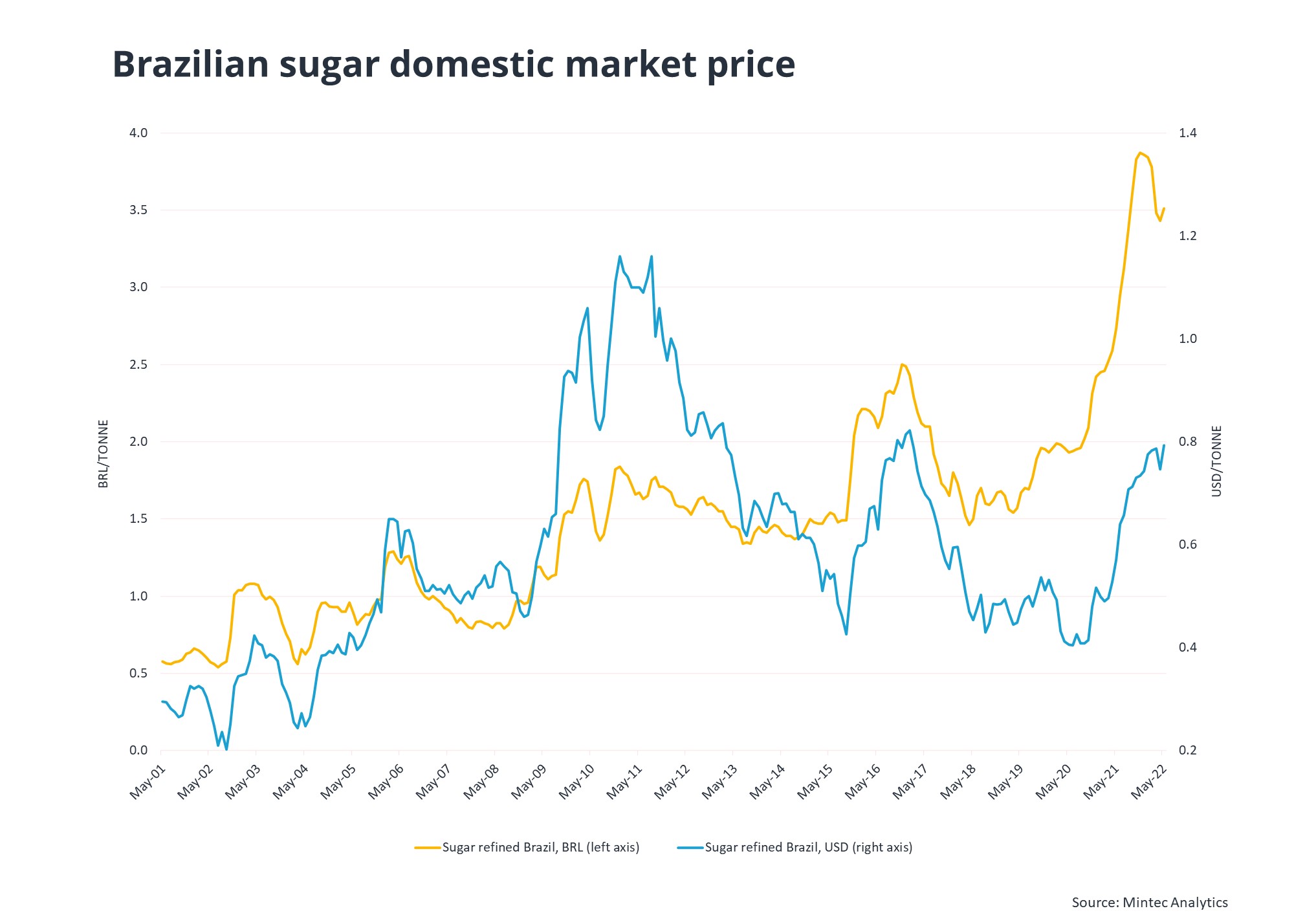

Refined Brazilian sugar averaged BRL 3.51 on the domestic market during May 2022, which is close to the all-time high peak of BRL 3.87/kg recorded in November 2021. High commodities’ prices are being driven by wider global inflation related to fuel and energy costs, while global sugar demand growth is anticipated to outweigh production growth during this calendar year. Thus, Brazilian sugar mills are poised to turn strong profits in 2022. Furthermore, the strength in global gasoline prices is making ethanol production increasingly attractive at the expense of sugar for human consumption. Brazilian sugar mills are anticipated to divert 57% of sugarcane feedstock into ethanol during the 2022/23 season, compared to 53% the previous year, which could tighten domestic availability of food-grade sugar and boost prices further.

However, firm sugar price projections are caveated with the strength of the BRL, which is one of the strongest performing currencies of the year-to-date, having appreciated by almost 20% against the USD since January. This is partly due to firm agricultural and industrial commodities prices, of which Brazil is a net global exporter and an important supplier. It also reflects an aggressively hawkish monetary policy with the Brazilian central bank lifting its basic interest rate over nine times during the last twelve-months – from 2.00% to 11.75% in May 2022. More hikes are expected through the CY, making the BRL an attractive investment asset, which will likely underpin further currency strength through Jun-Dec 2022. This strength of the BRL could weaken demand from Brazil’s key sugar export markets, including China, Algeria and India.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)