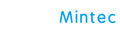

The price of gold [Mintec Code: GOLN] reached a record-high weekly average, settling at $2,170.98/Troy Ounce for the week ended 13th March, up 7.9% month-on-month (m-o-m), representing a 15% year-on-year (y-o-y) increase.

Source: Mintec Analytics

According to market sources, the recent rise in the gold price is largely due to the anticipation of cuts to interest rates in Western economies by mid-2024. As rates fall, the opportunity-cost of holding the non-yielding gold declines, thus theoretically becoming a more attractive investment for market players.

One market participant noted that “US rates and momentum” were bullish drivers in the gold market, adding that sentiment of ‘higher for longer’ interest rates could now be over.

However, in the US, headline inflation for February rose to 3.2% y-o-y, unexpectedly up from 3.1% y-o-y in January. The market had anticipated an unchanged annualized figure of 3.1% for February. While most players still expect a rate cut in June, some participants now believe the stronger inflation figure will cause a gold price correction, which one source had described as “already overbought”.

The gold price is a strong barometer of economic health and, more specifically, market views on interest rates. In an era of persistently high rates, Mintec will provide updates on the situation as more information becomes available, with the Federal Reserve’s next policy meeting taking place on 20th March.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

.png)