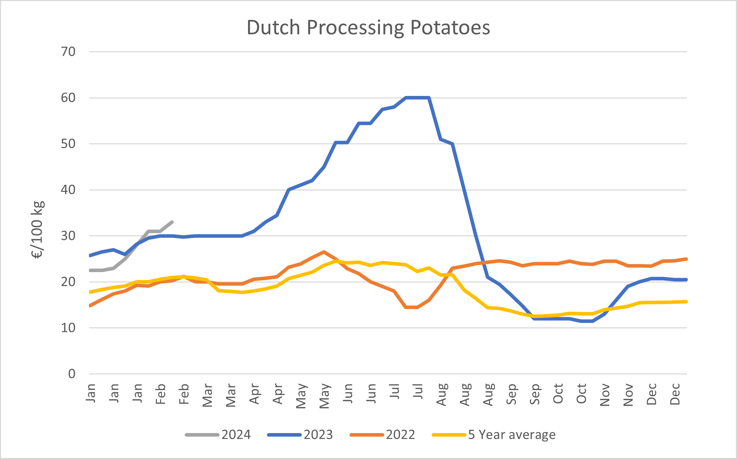

The demand for free-buy supplies of potatoes in the EU remains robust, but the supply is tightening. This is because many growers no longer have sufficient stocks to offer on the free-buy market due to quality issues that compromised storability, caused by last year's wet harvest. Those with supplies are aware of the supply shortage and are waiting for even higher prices. To top up their contracted supplies, buyers must increase their prices to incentivize growers to sell. On 27th February 2024, the Mintec Benchmark Price (MBP) for Dutch processing potatoes reached €37.5/100kg, the highest price for February since the price series began in 2014. According to market sources, limited supply is expected to continue to support prices as the market year progresses.

In the Netherlands, signs of the shortage are becoming apparent in the processing industry. VAVI, the processing organization in the Netherlands, processed 321.6 thousand tonnes of potatoes in January 2024, a decrease of 10.8% compared to the previous year . There has been a shortage of processing potatoes due to the challenges in obtaining them from suppliers. Dutch processing is becoming more reliant on supply from neighboring countries; in January 2024, 33.2% of the total supply was imported, compared to 21.4% of imports in January 2023.

Source: Mintec Analytics

Additionally due to heavy rainfall over harvest, a significant amount of potatoes were left in the saturated ground for an extended period of time. The NEPG (North-Western European Potato Growers) has estimated that 650 thousand tonnes were lost during harvesting or left in the ground and did not reach the market. The potatoes which were harvested during the wet conditions were no longer suitable for long-term storage. As a result, the availability of uncontracted supplies is very tight and processors have been competing each other for the limited stocks, which has continued to push up prices.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)