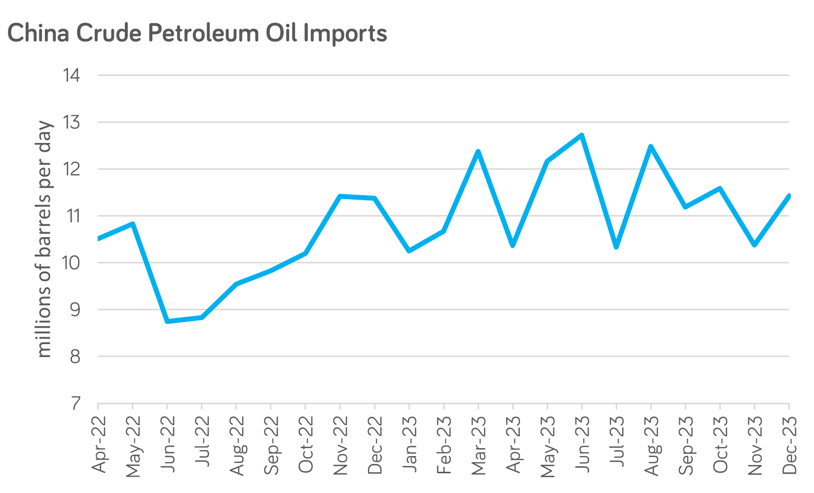

According to data from the General Administration of Customs and Mintec calculations, China’s imports of crude petroleum oil reached an average of 11.43m barrels per day (bpd) in December, up from 10.37m bpd in November.

The monthly figure represents a 10.2% month-on-month increase, up 0.5% year-on-year. As the world’s largest importer of crude oil, China’s monthly import data is an important price driver within the global crude oil market.

The monthly rise in crude oil imports comes against the backdrop of weak demand and a deflationary environment within the Chinese economy, as the Consumer Price Index (CPI) for December registered -0.3% y-o-y, up from -0.5% y-o-y in November.

China’s central bank announced additional liquidity for the banking sector in mid-January, but stopped short of cutting rates, holding the medium-term policy rate at 2.5%; monetary policy within the country, therefore, remains a major watch-point for future crude oil demand.

On the manufacturing side, the Purchasing Managers’ Index (PMI) registered 50.8, remaining in expansion territory (marked by a value above 50.0). Market sources believe that the sustained expansion in manufacturing may have partly fuelled the monthly rise in crude petroleum oil imports.

Despite the monthly import increase, however, the Brent crude oil price (DH-0) [Mintec Code: BCRD] only recently moved above the $80/barrel level. It closed at $80.04/barrel on 24th January, up 0.49% m-o-m, representing a 7.06% y-o-y decrease, against the backdrop of record-high US production and global macroeconomic uncertainty.

While the monthly increase in crude oil imports by China constitutes a bullish price driver within the global crude oil market in January, the overall market sentiment remains neutral to bearish despite military escalation in the Red Sea. However, market participants remain on high alert for any change in circumstances in the coming weeks.

Mintec will provide more updates as they become available, and further insights can be explored on Mintec Analytics, where you’ll find real-time price tracking, expert commentary, and customized alerts. Book a demo today to unlock the actionable intelligence you need to stay ahead of the curve.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

.png)