With a war in Ukraine, price inflation driven by energy and raw material price increases, Chief Procurement Officers (CPO) worldwide worked hard to maintain business operations, mitigate supplier challenges and navigate continued disruption and increased costs. As we look towards 2023, businesses continue to feel the effects and uncertainty of events, it is worth asking what challenges lie ahead for CPOs.

Below we’ve highlighted some of the critical challenges facing chief procurement officers how you might be able to combat these problems with data, analytics, forecasts and market insights.

-

Ongoing supply chain tensions

The food and manufacturing supply chain presents plenty of opportunities but also plenty of risks for businesses, especially those operating internationally. It is the job of CPOs to manage supply chain tensions and understand where risks are most likely to arise before they occur.

New reports indicate that supply chain tensions for both raw materials and manufactured products, resulting from the ongoing impact of the pandemic and the Russia-Ukraine war could cost over £780 billion in GDP in 2023. CPOs will have a challenge dealing with this supply chain disruption and working out how to minimise costs resulting from factors beyond their control.

-

Market volatility and unpredictable supplier prices

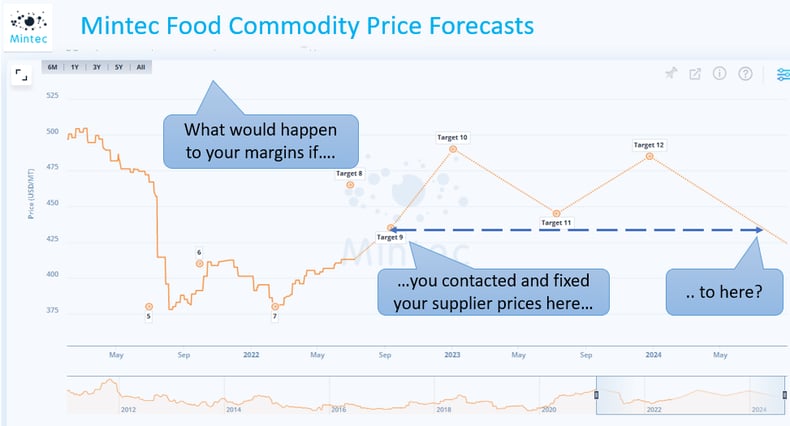

While price forecasts can give you a picture of the market in the coming months, there will still be a level of unpredictable price volatility that will be hard to account for given recent events. Meaning that medium to long term forecasts on their own may be only part of the solution

This price uncertainty will make the job of CPOs difficult in 2023, especially when they are deciding which avenues to pursue and how to plan their buying strategy and deliver greater predictability of earnings, COGS (Cost of Goods Sold) and ultimately profitability. Current market volatility is predicted to last through 2023 making it essential for procurement leaders to be able to adapt their buying strategy in response to changing market trends.

Having access to accurate commodity price forecasts combined with hedging advice and recommendations is essential to any market intelligence plan. Enabling buying teams to identify key buying points and to implement hedging strategies to minimise exposure to price risk across their COGS.

3. Knowing when and how to hedge price risk

Risk mitigation and management is key to developing and executing a successful procurement strategy. However, knowing when and how to hedge price risk will be far from easy in 2023.

In recent years we’ve seen that CPOs with robust and adaptable risk management programs have been able to hedge at the appropriate times and reduce overall risk.

To know when and how to hedge price risk, CPOs must remain informed and capable of making tough but quick hedge decisions. Advanced data and analytics are the best way to stay informed. Once you have the data the decision making, while still tricky, should be easier and will become easier over time.

-

Labor issues – shortages and the impact of pay

CPOs will also be challenged by labour shortages in 2023. In June 2022 the CIPD released a study stating that over 6 million people planned to quit their job in the next 12 months. 35% of people surveyed said that better pay was the motivating factor.

As the price of basic commodities continues to go up millions of people will be looking for improved pay, in their current position or somewhere else. CPOs will have to contend with the knock-on effect of these labour issues while carrying out their procurement responsibilities. Labour shortages, pay disputes and general job dissatisfaction are all factors that CPOs will have to take into account when operating in 2023.

These issues further drive the need for greater efficiency and productivity which in part can be delivered through technology but also where the time to train and on-board new employees can be minimized. Data and tools that integrate quickly into workflows and where there is a constant update of not only data but features to keep pack with changes in process and differences in the way industry sectors operate.

-

Price inflation

Many signs point to steep price inflation in 2023. If this turns out to be the case this will be another significant challenge for CPOs who need to make cost-effective decisions and adjust their procurement strategies accordingly.

A recent report by The World Bank warned of the risk of a global recession in 2023 and highlighted the need for policies to curb inflation without exacerbating the risk of a recession. As many organisations expect higher prices in 2023, it will be the job of CPOs to foresee, as much as they possibly can, when and where these price inflations are likely to occur.

Looking at price forecasts and predictions is the best way CPOs can prepare for any possible price inflation in 2023. Indeed, if CPOs keep a keen eye on the future, they will be able to limit price exposure and reduce hedging price risks.

-

Significant currency fluctuations

In article on with ExchangeRates.org.uk, Investment bank Socgen noted that “With recession fears growing and markets in turmoil after being hit by a pandemic, supply-chain shocks, China’s zero-COVID policy, higher energy prices and war in Ukraine, we are in the most sustained period of high volatility since the European debt crisis a decade ago.”

This volatility is likely to result in significant currency fluctuations in 2023. Large exchange rate swings and currency movements present challenges for CPOs trying to find marginal gains and make cost-effective decisions.

-

Customer demand outlook and inventory management

Demand in the world is dropping fast, and inventories, at all-time highs, need to be reduced. To succeed in 2023, CPOs need to know how to predict customer demand and what to do with that information.

Today there are a variety of digital tools that use real-time tracking technology to help with inventory management. These tools can help CPOs to increase efficiency, decrease workload and respond effectively to fluctuating customer demand. The ability to optimise inventory in line with market prices can enable CPO to reduce their COGS by avoiding higher prices or holding costly inventory as stock when lower prices might be available in the short term.

-

Ensuring contractual compliance

Another key challenge for CPOs is finding the right way to ensure compliance with contracts. It can be frustrating for CPOs who have put the work into sourcing and contracting new suppliers to see them being ignored in favour of less valuable alternatives.

In part the CPO is there to ensure the company has a strong buying position in the marketplace. If other members of the company fail to comply with established contracts the company’s buying position will be diluted, their reputation may be affected, and the workload of the CPO may reach unsustainable levels.

Having access to independent price data helps buying teams to negotiate better prices and validate their position with suppliers form effectively. By using market data and analysis to explain a price makes acceptance more likely and result in a percentage reduction in the negotiated price.

Summary

Ultimately, CPOs across industries will have to be innovative and committed if they want to overcome the many challenges facing them in 2023. The next year will test CPOs abilities of risk avoidance and risk management as businesses across the world contend with unpredictable markets, volatile commodity prices and new economic situations.

Alongside price inflation and volatility, CPOs will also be faced with supply chain tensions, labour issues and currency fluctuations. Preparation and proactivity will be key to combating these challenges and enabling CPOs to emerge from 2023 in a positive place.

To learn more about improving your chance of success in the commodity market in 2023 take a look at our market data, analytics and insights over at Mintecglobal.com.

"The Mintec Forecast Service delivers comprehensive analysis and clear hedging recommendations that enables our company to make data-driven decisions."

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)