Commodity prices have been on the rise in recent years, sparking concerns that inflation may be too high and hurting consumer spending. However, some economic experts believe the commodity price boom has just begun and will last several more years, with some predicting it will push commodity prices to all-time highs by 2026. Others are more cautious predicting that in the short term commodity prices may fall and experience continued volatility.

To understand why commodities are so important to our economy, take a look at these category charts that show the trend of global commodity prices suggesting that the boom is just getting started.

The world wants more metals

China has long been the world's largest consumer of steel, aluminum, copper and other metals. In 2018, China surpassed Japan to become the world's second-largest economy. With its economy continuing to grow and with China's ‘Made in 2025’ plan calling for a reduction in dependence on imports, it's no surprise that Chinese demand for commodities has grown substantially over recent years. Take steel, which is primarily made from iron ore, coking coal and scrap metal. For the first time ever, China became the world's largest producer of steel in 2017 by producing 77 million metric tons.

In 2016 and 2017 combined, China accounted for roughly 40% of global production. Demand for these raw materials has also surged across all sectors and suppliers have seen record profits as orders outpaced production. Intermediaries have struggled to meet demand amid price increases, while buyers have suffered from increased costs due to a shortage of supply. Mintec provides its clients with the commodity price forecast tools and advice to understand these supplier prices more effectively as well as global commodity price data, price forecasts & market intelligence for the CPG and capital goods supply chains.

New technology means new markets

New technology means new markets. For example, drones are a relatively new technology that's opening up new opportunities for businesses to provide services in areas that were previously inaccessible. Drones can make deliveries faster and cheaper than ever before, and the possibilities for their use are endless. The latest data from Lux Research shows that, by 2025, the market for drone-powered services will be worth $13 billion. As we build on existing technologies like drones, innovations such as blockchain are creating new marketplaces with unlimited potential. Blockchain provides a decentralized way of storing data on thousands of computers instead of just one server, which makes it impossible to hack and eliminates third-party interference. Minitec tools that assess market commodity prices and spend analysis can help companies to prepare accordingly.

Steel is responsible for half of all copper demand

Steel is responsible for half of all copper demand. While copper is not a component of steel, it is a major contributor to global demand. Demand for steel has been on the rise due to increased infrastructure spending in emerging markets and its low price relative to other metals. Increased demand has led to more recycling of scrap metal and faster depletion rates among mines. In 2013, China accounted for almost 60% of the world’s total steel output, followed by Japan (6%), India (4%), the US (3%), Germany (3%) and South Korea (2%). The U.S., as well as Europe, experienced some slowdown in the construction industry during 2007-2011 due to the economic turmoil which resulted in reduced demand levels for steel products in these regions. Cost models need to reflect this.

China drives the market

While China has been the economic engine driving global demand in the last two decades or so, its economy is showing signs of slowing and this has resulted in a drop in domestic demand. Nor has China escaped the wave of inflation that is currently spreading to all economies. This has a bearing on procurement that can be better understood with professional procurement software tools.

The slowdown in domestic demand in China has undoubtedly contributed to a rise in retail prices. The benchmark Shanghai Futures Exchange Copper Index also reached an all-time high earlier this month, even though production continues to increase. Aluminium has followed suit: after six years at lows not seen since early 2009, it recently surged to nearly

$1,900 per ton (about $2 billion worth) – nearly 60% higher than the price companies were paying on average just two months ago.

The US economy is growing faster than expected

The US economy is growing faster than expected, which means we are still in a commodity price boom. The IMF (International Monetary Fund) predicts that the US will grow 3% this year and 2.6% next year, while most other major economies are expected to grow less than 2%. This strong growth is partly due to rising productivity, but also because of tax cuts and higher energy prices. In contrast, Europe’s growth rate will be 1.8% this year and 1.7% next year and China’s growth is likely to hover at around 6.2% for both years. This is why Minitec tools are essential for effectively controlling costs and prices.

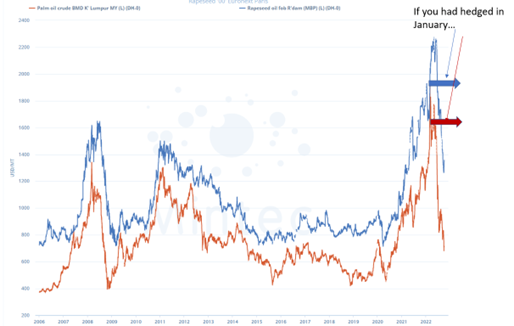

"Mintec forecasts mean you can buy early or hedge price risk before prices increase or avoid fixing prices to benefit from future cost reductions."

Tom Bundgaard, Chief Analysts Mintec.

Why Mintec?

On average, our customers tell us they can typically save over 2-3% on their COGS.

Using Mintec data in supplier negotiations, they can control price inflation and reduce proposed price increases across branded and private-label goods.

That means for every 100 million you spend on materials, Mintec could save you more than 3 million annually.

"We save a small proportion in a single negotiation using Mintec, but these savings can be significant when you spread it out across the year."

Mintec Customer

* Actual savings depend on several factors including the time frame over which the hedge was made and the volumes of materials purchased.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)