Norway is the dominant player in the global farmed salmon industry, accounting for approximately 50% of annual global output, and is Europe’s largest supplier. The sector is the second largest contributor to the Norwegian economy behind fossil fuels, receiving record export revenues of NOK 105.8 billion (USD 10.6 billion/EUR 9.7 billion) in 2022, up 30% year-on-year (y-o-y). In September 2022, the Norwegian government revealed plans to introduce a new tax to salmon farms in 2023. The incentive was to ensure that a portion of the value-added profits generated by industry provided greater social benefits, particularly to the coastal communities that accommodate salmon aquaculture. However, significant unrest ensued in the months following the announcement, with stakeholders citing a lack of clarity over how the new system will work and expressing fears about industry growth.

This article explores the key aspects of the salmon tax and what it could mean for production, investment and prices.

The history and current state of the salmon tax

In September 2022, the Norwegian administration proposed the idea of new tax for salmon and trout producers, to be introduced from 1st January 2023. The period preceding the January deadline was used to gauge public sentiment through consultations with key stakeholders. These meetings revealed widespread concerns, leading the government to reassess the framework. A new proposal is now expected in March 2023, with a view to the bill being fully signed off and operational by late-Q2 2023.

How will the tax be calculated?

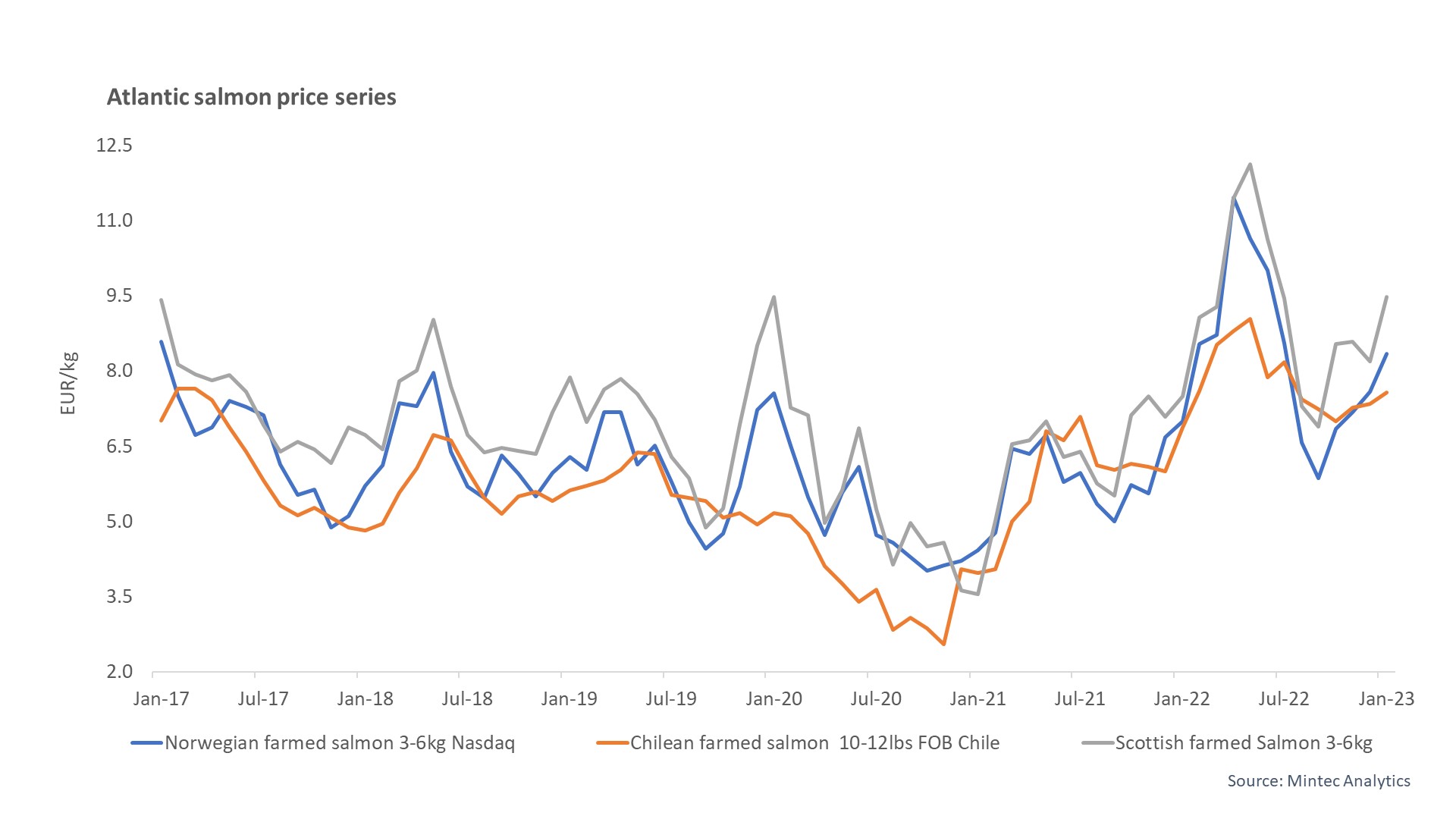

The initial government proposal was for a 40% VAT requirement for all farms harvesting a minimum of 5,000 tonnes per year of salmon or trout. The levy would serve as a ground rent, charging farmers for the value added to fish during the period spent maturing in coastal waters. Another way of looking at it is as a ’resource tax’ to distribute the large profits extracted from the use of a public good, in this case the sea. The tax would be based on average spot prices reported on the Nasdaq index, which reports sales of high-grade salmon, typically sold at the highest price. The government estimates that 30% of Norway’s salmon farmers would pay the tax, netting revenues in the region of NOK 3.7 billion (USD 370 million/EUR 341 million) in 2023.

What is the stakeholder sentiment?

Lower capital investment

One prominent agricultural investor believes that less self-generated capital will be made available for the salmon industry, due to lower profits after tax. Lower access to capital, and thin risk appetite, could also weaken the supplier industry, which is responsible for much of the innovation within the salmon sector. The Norwegian Seafood Federation estimates that approximately NOK 35 billion (USD 3.5 billion/EUR 3.2 billion) worth of capital investments were postponed or cancelled during the four months through January 2023, and hundreds of process plant workers were also made redundant. The technologies required to develop smolts – salmon that are ready for the crucial sea-growth phase – are highly capital intensive, necessitating attractive returns to stimulate investment. However, unattractive returns could result in fewer capital investments, resulting in slower capacity growth.

Erosion of Norway’s competitive advantage

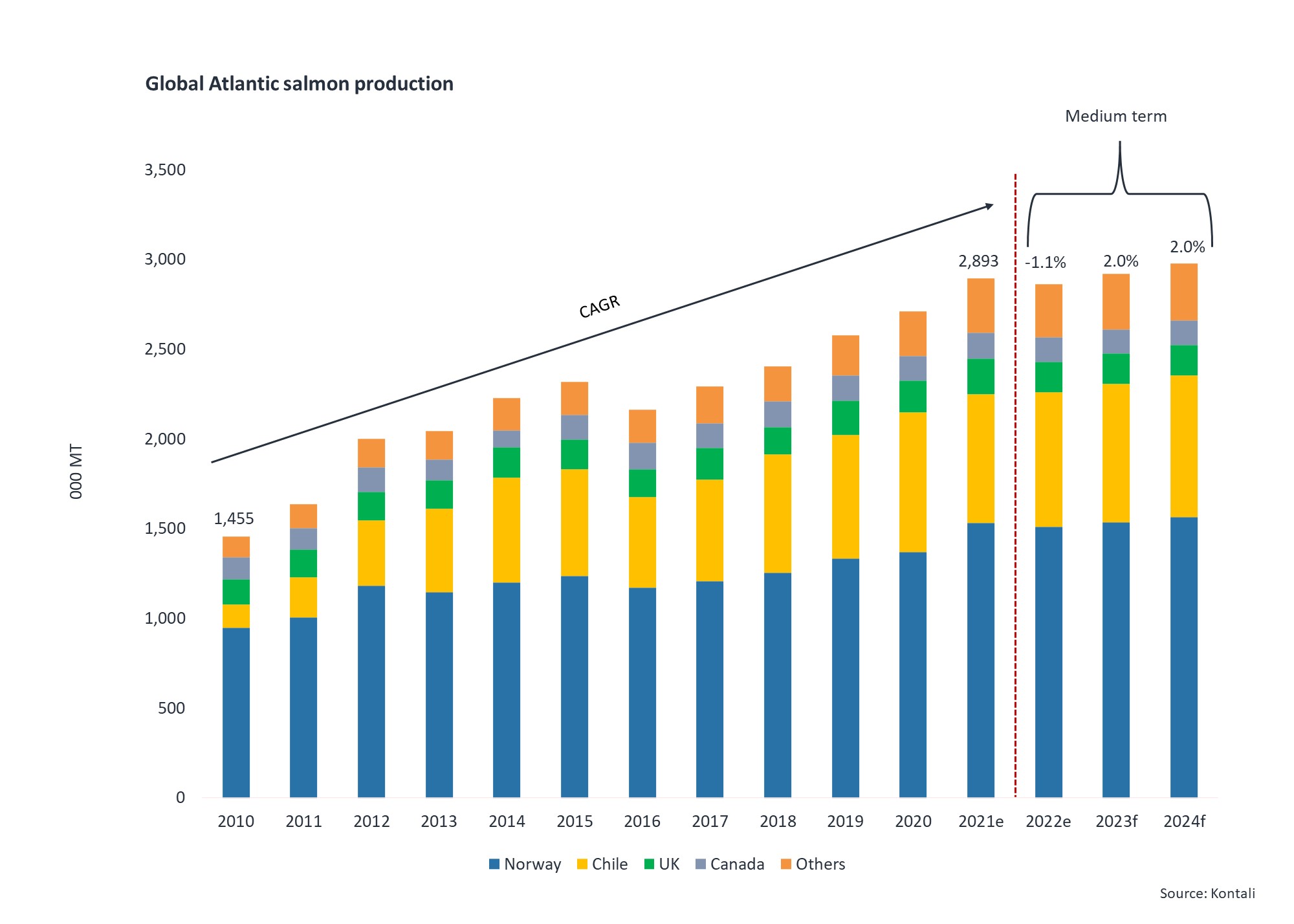

Industry insiders say that a substantial proportion of potential capital investments have been postponed or completely abandoned since the proposal announcements, which could lead to a significant reduction in Norwegian salmon output over the coming years. The salmon farming sector is a long-term growth business, where global output grew by 1.44 million tonnes from 2010-2021, representing a total increase of 99% over the period and compound annual growth rate (CAGR) of 6.4%. The key players in this growth were Norway, with an increase of 0.58 million tonnes (CAGR of 4.5%) over the period, and Chile with a similar volume increase of 0.58 million tonnes (CAGR of 16.8%). Mintec projects Norwegian production growth to increase by approximately 3.3% between 2022 and 2024. However, if this were to fall to 0.5-1%, it would lead to a tighter market and higher prices.

Higher Norwegian prices would benefit some marginal producers in countries, such as Chile and Scotland, that would become more price competitive, leading to higher prices paid by the end consumer.

Less value-added salmon production

A recurring concern among stakeholders relates to the tax being calculated based on the Nasdaq spot price. Processed salmon are typically sold on fixed-price volume contracts, which are often pegged below the reported spot price. Therefore, farms entering fixed price supply contracts would incur the risk of being taxed on a spot price that is higher than actual income received from sales. This could slow processing activities and hamper the value created within the industry, reducing access to capital and industry Investment. This would then create secondary impacts for industries, such as feed producers that are solely dependent on salmon farms, exacerbating a negative growth spiral. The volatility associated with spot prices would not only increase the risk burden placed on primary processors and wholesalers, it could also lead to reduced processing activity and, over time, a weakened market position for Norwegian salmon. This weakened market position could affect the salmon price and profitability, particularly during the vital sea-growth phase.

Weaker taxable revenues in future

During a consultation with the Norwegian government in November 2022, the Head of Seafood at Norway’s DNB Bank explained that industry value creation would be hindered under the 40% tax, with some farms liable for 80-100% taxable income, when additional levies are considered. The extra revenue raised from the tax would be weighted more heavily in the short term, decreasing over the next 5-10 years, as larger farms would become increasingly disincentivised to purchase additional production licenses, implying negative production growth, thus eroding the pool of taxable revenues in the future.

What is the current state of affairs?

The tax is now in effect and will be applied to production volumes above 4,000 metric tonnes, although the final decision on the amount payable will not be made until June or July 2023. Most estimates point towards 15-20% tax, as opposed to 40%. Salmon share prices on the Oslo Stock Exchange rose in early January 2023 week, following reports of a likely 15% tax

The Norwegian government is also deciding on the methodology used for tax calculation. Consultations between the industry and the government revealed farmers were more open to the prospect of a tax based on actual received prices per salmon, which account for the quality and size of each fish rather than a flat tax based on the Nasdaq price. Such a system would be less impactful for most farmers, particularly those without the technology and capacity to produce the high-quality salmon benchmarked on the Nasdaq exchange. For now, it is a matter of wait-and-see.