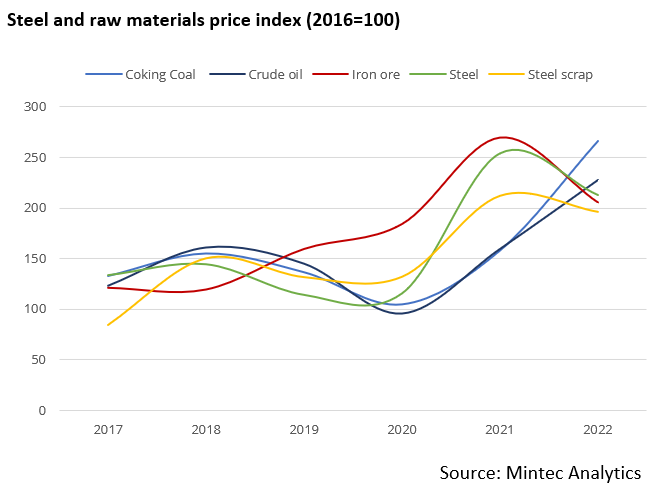

Comparison of steel and raw material price indices

The annual average steel price in 2022 fell by 17% relative to 2021. Only the iron ore price decline was more significant, dropping 24% over the same period. But looking at the price indices as of December 2022, steel has the lowest average monthly value of all the commodities featured in the graph above.

One of the most important factors that influenced steel prices was the cost of production and energy costs in particular. The outbreak of war in Ukraine resulted in sanctions on Russia, which exports oil, coal and gas. As a result, the hydrocarbon market has seen a significant shift in commodity flows and has not yet been able to come to a balance. The rise in the oil price, up 43% year-on-year (y-o-y) in 2022, reflects rising inflation in general and global energy costs in particular. The coking coal (top energy material for steel for flat products) index was up 68% y-o-y in 2022 and, in December, was at the highest value of all the price indices examined. Shortages of natural gas and coal in Europe for electricity generation led to annual energy price increases averaging around 125% over 2022. This particularly affects steel producers using electric furnaces, where electricity is a key cost item.

The price of iron ore in 2022 decreased by an average of 24% over the year, but it is worth noting that compared with other indices, it was significantly higher in the 2020/21 period. Overall, all price indices from 2017 to 2021 were correlated, but iron ore was influenced by strong demand from China. The country consumes around 60% of all iron ore and its share of the seaborn market is around 80%, so demand from China is a key factor in global price formation. In 2020, despite the pandemic, China increased its iron ore consumption by 7%, while there has been a cumulative drop of 7% in demand from other countries. Iron ore demand in China started to decline in 2021 and continued to fall in 2022. Nevertheless, iron ore prices rose in 2021 as the global economy grew.

As a result of divergent trends in raw materials, Mintec estimates that the variable cost index for BOF steel production decreased by 10% in 2022 compared to the previous year. Taking into account that the steel price index declined by 17%, it is evident that steel producers' margins fell significantly. In particular, this has been reflected in the reduction of steelmaking capacity, especially in Europe. Electro-melting facilities that melted steel scrap using electric power were especially affected, as steel scrap prices fell by only 7% in 2022, while electric power surged by 125% on average in Europe. Against this backdrop, the most dramatic decline in steel production was in Turkey, where more than 70% of steel is made in electric furnaces. In the first 11 months of 2022, steel production in the country dropped by 12.3% y-o-y, but the decline is accelerating, as in November 2022, the figure fell by 31% y-o-y and by 17% month-on-month (m-o-m).

Outlook

Steel prices appeared to reach a bottom at the end of 2022, mainly because of high production costs. Further declines in raw material prices are possible, but energy costs will likely remain high.

Given the rapidly decreasing steel market prices in H2 2022, many consumers and distributors have decreased purchasing to reduce stock levels. The purchases were falling faster than real steel demand. Therefore, purchasing activity is likely to pick up on both spot and contract markets as soon as consumers realise the bottom has been reached.

Steel production stoppages will eventually lead to a reduction in supply by such a large amount that the market balance will be restored, and prices will start to rise again.

Steel demand growth has a strong historical connection with general economic growth. The IMF predicts that world GDP in 2023 will grow by 2.7%, which will be the lowest growth rate since 2009 (not including 2020, when the pandemic began). However, many analysts expect even lower growth. For instance, J.P. Morgan Global Research, in a December publication, expects global GDP to rise by only 1.6% in 2023 and China to expand by just 4%.

China could also change the steel market, but Q1 2023 will be uncertain. The Chinese government is seeking to stimulate consumers, which should boost the construction and automotive industries. As a result, demand for steelmaking raw materials will rise, which will be reflected in higher prices in the global market.

For steel consumers in the US and Europe, the start of 2023 will also be uncertain. In February and March, the general trend of raw materials used in steel production, and consequently the cost of production, will become clearer, which will determine the prices of steel products. Provided the December 2022 m-o-m price increase is maintained in Q1 2023, there will be an increase in purchasing activity and price growth.

The outlook will be discussed in more detail at a webinar dedicated to metals in packaging, which will be published on the Minteс platform in early February. Sign up here for the recording.

Benchmark price selection methodology for calculating indices

Steel price: hot rolled coils in the northern European market. In order to make the steel prices comparable to benchmark steel prices, the indices have been converted to USD.

Iron ore and coking coal: the price of imports at Chinese ports.

Scrap metal: the import price of Turkey, the largest importer of steel scrap in the world.

The price of Brent crude oil is intended as a general indicator of the world economy.

The year 2016 was chosen as the basis for calculating the indices.